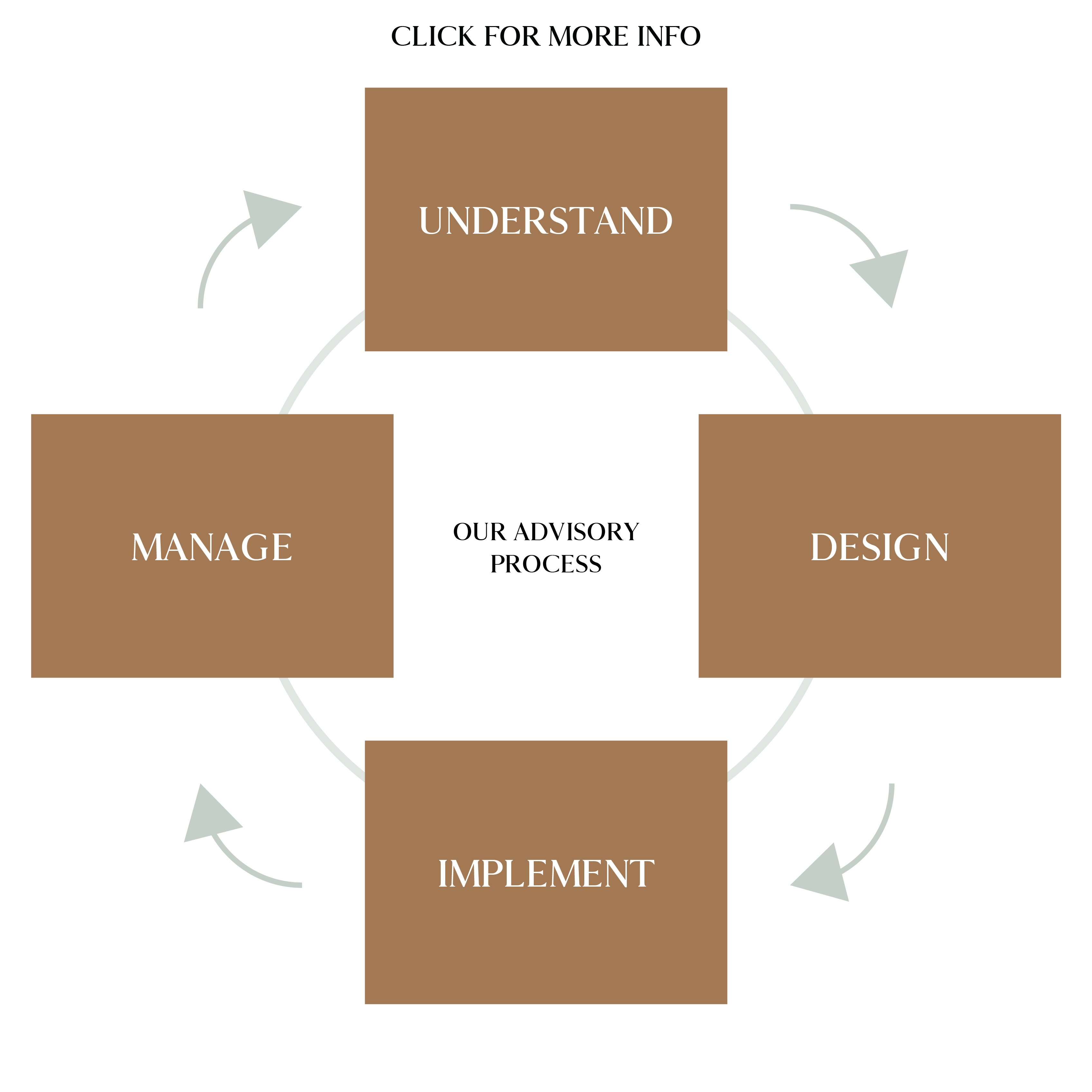

Everything you need to build your heritage with clarity and purpose.

Personalized Advice

Every client we work with has unique goals and circumstances. We will get to know you and your family so that we can build and execute a plan that is as unique as you.

Holistic Approach

We’re built for depth, not breadth. We’ll never be the biggest firm in town - nor do we aspire to be. We care more about building true relational depth with each and every client we serve.

Proactive Guidance

Your financial life has a lot of moving pieces - between investments, taxes, legal, insurance and more - we’ll bring it all together in a way that makes sense and moves you towards your goals.

Relational Depth

We won’t wait around for your next quarterly review to reach out. Working with our boutique firm means that we are consistently looking for opportunities to impact your wealth and your life.

*click to expand

+ Financial Planning

As Certified Financial Planner™ professionals, our holistic approach means starting with a big picture view of your finances, helping you get organized, clarifying your values and priorities, and pulling all the different component pieces of your financial life together. It’s this approach that will help create an integrated plan that allows you to build your heritage with clarity and purpose.

+ Earning + Saving

As you’re earning and saving money, we’ll leverage insights from decades of clients that we’ve helped save, invest, retire, sell their businesses and create a true heritage. The decisions you make in these years should reflect your values. We’ll make sure you make proactive decisions to do exactly that.

- Cash Flow + Budget Management

- Credit + Debt Management

- Insurance Selection (Life, Disability, Property & Casualty)

- Employer Benefits Maximization

- Short-, Mid- & Long-Term Savings

- Large Purchase Planning

- Education Savings

+ Investment Management

Leveraging investing opportunities can be the most practical and straight-forward way to build wealth. The details can get complicated, but we’ll help you manage all the moving pieces to take advantage of an investment approach that makes sense for your plan.

- Net Worth + Goal Tracking

- Cash Management

- Stock + Mutual Fund Portfolio Design + Management

- Roth + Traditional IRAs

- 529 Plan Management

- Tax- and Cost-Sensitive Strategies

- Covered Call Writing

- RSU + Incentive-Based Compensation

+ Retirement Planning

Getting to and through retirement is an exciting but uniquely challenging time. You’ve saved and invested well, but all of a sudden there are a whole new set of rules to follow. You deserve to have peace and clarity as you enjoy these fruitful years. Our goal is to help you do exactly that.

- Retirement Income Distribution Planning

- Strategic Tax Considerations

- Social Security + Medicare Strategy

- Health + Long Term Care Considerations

- Risk-Adjusted Portfolio Management

- Empowered Spending

+ Legacy Planning

Your heritage is about much more than just your money. Oftentimes, you can use your wealth to influence and activate how you’re remembered and the impact you have on the people and causes you care about most. We’ll help you activate your heritage with clarity and purpose through strategic legacy planning.

- Estate Planning (Wills, Trusts, POAs)

- Estate Tax Considerations

- Life Insurance Planning

- Charitable Planning

- Non-financial Goal Fulfillment

- Small Business Exit + Succession Planning